Are you a mom trying to stretch every peso while juggling work and family life? The constant pressure can feel overwhelming—especially when unexpected expenses arise.

But what if I told you there’s a way to grow your savings and earn passive income, all from the comfort of your home?

It may sound too good to be true, but stock market investing offers exactly that. The right approach can help you secure your family’s financial future and build wealth over time.

Stock Market Investing in the Philippines: A Growing Trend

In recent years, stock market participation in the Philippines has seen significant growth. As of the end of 2023, the Philippine Stock Exchange (PSE) reported approximately 1.91 million stock market accounts, reflecting an increase from the previous year.

Notably, online accounts experienced a substantial rise, standing at 1,525,768, which is a 21.2% increase or an addition of 266,861 accounts compared to the prior year.

This upward trend indicates a growing interest among Filipinos in stock market investing, driven by the accessibility of online trading platforms and a heightened awareness of the benefits of investing.

For moms looking to enhance their family’s financial future, now is an opportune time to consider entering the stock market.

My Journey in the Stock Market

I first learned about stock market investing while working overseas as a Medical Technologist. My cousin introduced me to the idea, and I was skeptical at first. Stocks seemed like a game for financial experts or people with deep pockets.

But as I learned more, I realized it was accessible—even for beginners like me. I started small, investing a portion of my salary in blue-chip and dividend stocks.

Over five years, my consistent investments grew, and little did I know this decision would become a lifeline when I returned to the Philippines after the pandemic to focus on my family.

That experience taught me one important lesson: Stock market investing isn’t just for the wealthy—it’s for anyone willing to learn.

This guide will show you how moms like us can use the stock market to build wealth and create passive income for our families.

Disclaimer: I am not a financial advisor. This post is for informational purposes only. Please do your own research or consult a professional before making any investment decisions.

Why Stock Market Investing is Perfect for Filipino Moms

Stock market investing may seem intimidating, but it’s perfect for moms looking to grow their savings and secure their family’s future.

Why Moms Should Consider Investing:

✅ Grow Your Savings Faster: Stocks offer higher potential returns than traditional bank accounts. Imagine your money growing at a rate that outpaces inflation.

✅ Accessible Even for Beginners: You don’t need a huge capital to start. Many brokers allow you to begin investing with just a few thousand pesos. For example, COL Financial lets you start with as little as ₱1,000.

✅ Flexible and Convenient: Invest at your own pace and schedule—ideal for busy moms!

Addressing Common Fears:

- “It’s too risky.” Yes, there’s risk, but learning the basics and diversifying your investments can minimize it.

💡 Tip: When I first started, I was so scared of losing money that I checked my portfolio daily—lol! It turned out, I was just stressing myself out. Don’t do this!

- “It’s only for experts.” Not true! With the right guidance and tools, even beginners can succeed in the stock market.

Types of Investments in the Stock Market

Navigating the stock market can feel overwhelming, but understanding your options makes it easier.

Here are three beginner-friendly investment types:

1. Growth Stocks

These companies reinvest profits to expand operations, making them ideal for long-term wealth building.

Examples: JFC, PLDT, SM, BDO, and Meralco

2. Dividend Stocks

These companies pay regular dividends, providing consistent passive income.

Perfect for moms seeking stability and cash flow.

Examples: Globe Telecom, Metrobank. and SCC

3. Index Funds and ETFs

These funds track the PSEi or global markets, offering exposure to a variety of companies with less effort.

Great for beginners looking to diversify.

Examples: First Metro Equity Exchange-Traded Fund (FMETF), Philequity PSE Index Fund, and BDO Equity Index Fund

💡 Note: I started with index funds and blue-chip stocks like Metrobank and Ayala Land.

Why Choose Blue-Chip Stocks?

Blue-chip stocks are shares of well-established, financially stable companies with a proven track record of reliability and performance.

These companies are often leaders in their industries, have strong financials, and consistently pay dividends.

✅ Benefits: They offer lower risk compared to smaller or newer companies and are known for weathering economic downturns.

Example: In the Philippines, blue-chip stocks like Ayala Land, BDO, and SM Investments are part of the Philippine Stock Exchange Index (PSEi), which represents the top 30 companies by market capitalization.

By investing in blue-chip stocks, you’re essentially putting your money in businesses that have stood the test of time, making them a solid foundation for any portfolio—especially for moms seeking stability and long-term growth.

How to Get Started with Stock Market Investing in the Philippines

Getting started is simpler than you think.

Follow these steps:

a. Choose a Platform

Popular brokers like COL Financial, BDO Nomura, and BPI Trade are reliable options. New fintech apps also offer user-friendly experiences.

💡 Tip: My personal recommendation is COL Financial because it’s beginner-friendly and has educational resources.

b. Set Your Budget

You don’t need to start big! Even ₱1,000 is enough to open an account. Start small and grow consistently.

💡 Pro Tip: To minimize service fees, aim for ₱8,000 per transaction.

c. Learn the Basics

Familiarize yourself with terms like “shares,” “PSEi,” and “blue-chip stocks.”

Many brokers, like COL Financial, provide guides, stock recommendations, and tools like Fair Value (Target Price) and Buy Below Price (BBP).

d. Build Your Portfolio

- Mix growth stocks for long-term gains with dividend stocks for immediate income.

- Diversify across industries like utilities, telecom, and banking to minimize risk.

Why Dividend Investing is a Smart Option for Moms

Dividend stocks are a great choice for moms because they:

✅ Provide Regular Passive Income: Use dividends to reinvest or cover household needs.

✅ Offer Stability: Dividend-paying companies are typically well-established.

✅ Promote Compounding Growth: Reinvesting dividends accelerates wealth-building.

Local Examples are Philippine companies like:

- Globe Telecom

- JFC

- Metrobank

- Meralco

- Ayala Corp

- PLDT

- San Miguel Corporation

- BDO Unibank

- SCC

These are known for paying reliable dividends and can help moms achieve financial stability.

Tips for Successful Stock Market Investing

✅ Start Small and Be Consistent: Even small amounts add up over time, thanks to compounding.

💡 Trivia: Albert Einstein reportedly called compound interest the “eighth wonder of the world.”

✅ Think Long-Term: Avoid reacting to short-term market fluctuations. Investing is like planting a tree—it takes time to grow.

✅ Diversify Your Portfolio: Spread investments across industries to reduce risk.

✅ Stay Educated: Attend financial literacy webinars, read books, or follow trusted financial experts.

✅ Use Online Tools: Apps like Bloomberg or Moneygment help track stocks and monitor trends.

💡 Pro Tip: Set price alerts on your broker’s platform to buy or sell at optimal prices.

Real-Life Example: How Stock Market Investing Helped My Family

When I decided to return home to the Philippines in March 2022 after the pandemic, I also made one of the most significant choices of my life—to become a full-time, stay-at-home mom for my son.

This transition meant I wouldn’t have a stable income for nearly three years. Naturally, the thought of relying solely on our savings and my husband’s income was daunting.

Thankfully, my stock market investments became a financial lifeline during this time. The passive income from dividends helped supplement our household expenses and gave us breathing room when unexpected costs arose.

Having invested consistently in blue-chip and dividend stocks while working overseas, I was able to reap the rewards during a time when we needed them most.

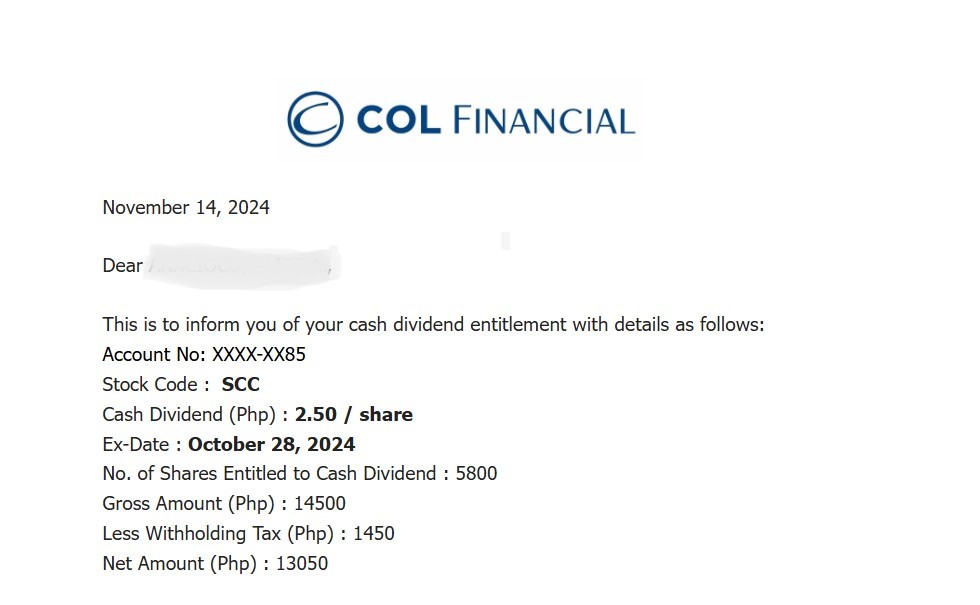

Below is a screenshot of my dividend notification for my SCC stock from COL Financial dated November 14, 2024.

Whenever cash was tight, I would sell a portion of my stocks to cover immediate needs. Although I didn’t always wait for stocks to hit their Target Price or Fair Value, I was grateful for the flexibility the stock market provided.

It allowed me to address our family’s financial needs without taking on debt or unnecessary stress.

This experience reinforced a valuable lesson: consistent investing, no matter how small the amount, can build a safety net over time. It’s a testament to the power of preparation and patience.

If I can do it, so can you. By taking small but steady steps today, you, too, can build a financial cushion that could support your family when life throws unexpected challenges your way.

💡 Pro Tip: Consider reinvesting your dividends whenever possible—it accelerates your wealth-building journey!

Conclusion

Stock market investing is more than just a way to grow your savings, a powerful tool to take control of your financial future and secure a brighter tomorrow for your family.

As moms, we often put our family’s needs above our own, but investing is a way to prioritize your family’s long-term security while also empowering yourself.

Yes, the stock market can seem intimidating at first, but every expert investor started as a beginner. You don’t need to be a financial whiz or have a large sum of money to get started. All you need is the willingness to learn, a bit of patience, and the determination to take that first step.

Imagine this: A year from now, you could be watching your investments grow, celebrating every dividend payout as a step closer to your financial goals.

Five years from now, you could look back and be proud that you decided to invest today—because that decision could pave the way for your children’s education, your dream home, or a worry-free retirement.

Your Next Step

Here’s your action plan:

✅ Open a brokerage account.

Don’t overthink it—just start! Explore platforms like COL Financial or BDO Nomura.

✅ Learn the basics.

Equip yourself with knowledge. Read articles, attend webinars, and follow trusted financial experts.

✅ Take the first step.

Invest even a small amount and stay consistent. Watch how your money grows over time.

Remember, every peso you invest today is a seed for your family’s future. It’s not about getting rich overnight, it’s about building something sustainable and meaningful for the people you love most.

You’ve got this, mom! And you don’t have to do it alone.

Explore my blog for more tips and personal stories to guide you on this exciting journey. Together, let’s build a life where financial security is no longer a dream but a reality.

Beyond Stocks: How Wealthy Affiliate Can Boost Your Passive Income

Alternatively, Wealthy Affiliate can help you start an online business, offering another avenue to generate passive income. Wealthy Affiliate provides comprehensive training, tools, and support to build and grow a successful affiliate marketing website.

Unlike the stock market, which requires capital investment and market knowledge, Wealthy Affiliate empowers you to earn income by promoting products and services you are passionate about. This platform allows you to create content, drive traffic, and earn commissions without the need for extensive financial expertise.

Whether you’re new to online business or looking to diversify your income streams, Wealthy Affiliate offers a scalable and sustainable way to achieve financial freedom.

Another tip, it’s better to put your extra money in investment than in regular savings.

Great point, Janette!

Investing extra money can indeed help it grow over time, unlike regular savings, which lose value due to inflation. The key is finding the right investment that matches your goals and risk tolerance.

Thanks for sharing your insight!”

Stock market investing can be an empowering way for Filipino moms to build long-term wealth and create passive income, but the approach needs to be tailored to their financial goals and risk tolerance. Understanding fundamental analysis, market trends, and the impact of economic factors in the Philippines can make a significant difference in investment success.

How can Filipino moms leverage local and global investment opportunities while balancing the need for financial security in an unpredictable economy?

Thank you for your insightful comment.

You are absolutely right—tailoring investment strategies to individual financial goals and risk tolerance is crucial for achieving long-term wealth and passive income.

For Filipino moms (like me), the journey into the stock market can be both empowering and rewarding when approached with the right knowledge and tools.

I actually mentioned most, if not all, of these points in the post, but it’s always great to reinforce their importance.

To leverage local and global investment opportunities while balancing the need for financial security, I recommend the following steps:

1. Educate Yourself: Understand the basics of fundamental analysis, market trends, and the economic factors that impact both local and global markets. This knowledge will help you make informed investment decisions.

2. Diversify Your Portfolio: Spread your investments across different asset classes and sectors to minimize risk. Consider a mix of local stocks, international stocks, bonds, and other investment vehicles that align with your financial goals.

3. Set Clear Financial Goals: Determine your short-term and long-term financial objectives. Whether it’s saving for your children’s education, building an emergency fund, or planning for retirement, having clear goals will guide your investment strategy.

4. Stay Informed: Keep up to date with market developments, economic news, and any changes in regulations that may impact your investments. Staying informed will enable you to adapt your strategy as needed.

5. Seek Professional Advice: If you’re uncertain about where to start or how to proceed, consider consulting with a financial advisor. They can provide personalized guidance based on your unique situation and help you create a comprehensive investment plan.

6. Practice Patience and Discipline: Investing in the stock market requires a long-term perspective. Avoid making impulsive decisions based on short-term market fluctuations. Stick to your investment plan and adjust it only when necessary.

By taking these steps, Filipino moms can confidently navigate the stock market and build a secure financial future for themselves and their families. Remember, the key to successful investing is continuous learning and adaptability.

Thank you again for your valuable input, and I look forward to hearing more from you!